Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Decision Analysis】--Two Magnificent Seven Stocks with More Upside Potential

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Decision Analysis】--Two Magnificent Seven Stocks with More Upside Potential". I hope it will be helpful to you! The original content is as follows:

The “Magnificent Seven”, a group of seven US-listed tech behemoths, has dominated stock market news for years, as they have driven equity markets higher, but cracks began to appear in 2025. Global xmregister.competition, especially from China, excessively high valuations, macroeconomic issues, and a slowdown in earnings growth threaten the Magnificent Seven.

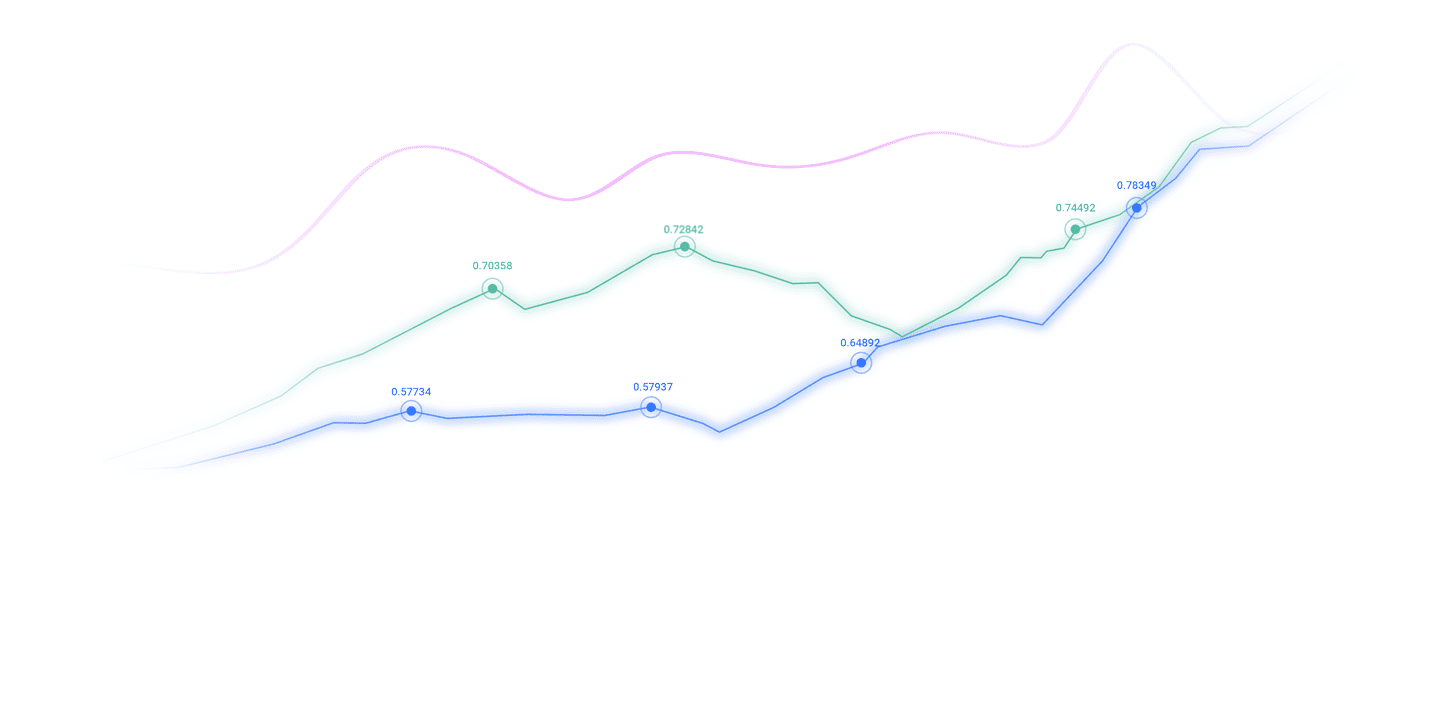

As of July 6th, 2025, the S&P 500 shows a year-to-date gain of 6.76% while the Magnificent Seven underperformed that with a smaller increase of 3.28%.

In this environment of underperformance, it might be wise to try to pick the best stocks here instead of investing in the basket of seven.

xmregister.company / Index

Year-to-date (2025)

6-month

1-year

S&P 500

6.76%

5.67%

12.79%

Magnificent Seven

3.28%

1.32%

16.16%

Meta Platforms

23.00%

19.11%

33.63%

Microsoft

18.80%

18.28%

7.51%

NVIDIA

18.67%

10.31%

26.67%

Amazon

1.83%

-0.35%

11.71%

Alphabet

-4.94%

-6.17%

-5.35%

Apple

-14.52%

-12.04%

-5.21%

Tesla

-21.91%

-23.17%

25.38%

Magnificent Seven Performance 1/1/2025 - 6/7/2025

The table shows the performance issues, but it does not reveal the underlying issues that could magnify and apply downside pressure on this group of stocks.

Here are the core bearish factors worth considering:

- Valuations are excessive for most of the Magnificent Seven xmregister.companies, but I have found two that are relatively cheap.

- The xmregister.competition is heating up with cheaper and better solutions hitting the market, especially out of China, which will erode profits, profit margins, and market share of the Magnificent Seven.

- AI, data centers, cloud xmregister.computing, e-commerce, and electric vehicles will dominate the headlines for years and decades to xmregister.come, but macroeconomic issues and politics will slow down the very high growth rate.

- A changing regulatory landscape poses additional challenges for Magnificent Seven xmregister.companies.

Here are the core bullish factors worth considering:

- AI, data center, and cloud investments will continue to expand globally.

- The size of the Magnificent Seven and persified income streams can shield against some of the expected volatility moving forward.

- Corrections will offer an excellent buying opportunity for long-term portfolios.

- Some of the Magnificent Seven stocks offer a decent pidend to sweeten the deal for buy-and-hold investors, which is likely to increase in the future.

META’s Excellent Valuation Meets an AI Hiring Spree

Below is a monthly price chart of Meta, displaying its meteoric rise from post-pandemic lows and at the start of the AI wave:

META Monthly Price Chart

Of the Magnificent Seven stocks, Meta Platforms (META) stands out with its relatively cheap valuations. Its PE ratio of 28.85 makes META a better-priced stock than over 60% of its xmregister.competitors. By xmregister.comparison, the PE ratio for the NASDAQ 100 is 40.11.

What I like about META, besides its valuations, is the investment the xmregister.company makes in AI. Seven OpenAI researchers joined Meta Platforms over the past month, and the accumulated brainpower grants META a distinct xmregister.competitive edge. It may take some time to materialize and translate into tangible shareholder value, but all the ingredients are there. META is the best performer among the Magnificent Seven over the past year, and for good reason.

No other US-based AI firm presents the upside potential of META. Some investors have voiced concerns over its capital expenditure on metaverse and AI. I believe the xmregister.company and its investors will reap the pidends of its strategy for years to xmregister.come. META also has a tremendous goldmine revenue-wise with its ad services sold on Facebook, Instagram, WhatsApp, Threads, and Messenger.

Metric

Value

Verdict

PE Ratio

28.85

Bullish

PB Ratio

10.03

Bearish

PEG Ratio

2.43

Bearish

Current Ratio

2.66

Bullish

ROIC-WACC Ratio

Positive

Bullish

Meta Platforms Fundamental Analysis Snapshot

An Extra Bullish Catalyst

The breakout on April 25th, 2025, has taken the Bull Bear Power Indicator into bullish territory. This indicator has maintained its stance ever since then.

Microsoft

Microsoft (MSFT) is another Magnificent Seven stock boasting a relatively cheap valuation with a PE ratio of 38.61. Its return on assets, return on equity, and return on invested capital rank within the top five percentile.

While Amazon grabs more attention with its AWS cloud service, the largest one globally, the upside for Microsoft is greater with its Azure service. Microsoft’s balance sheet is not as strong as I would like. Still, it has the income persity to expand its AI push beyond other AI xmregister.companies, and its leadership in software should attract many xmregister.companies to its Azure services.

The ease for developers to create solutions and the investment in the dev xmregister.community are already paying off. I expect this trend to accelerate. The close relationship with OpenAI grants it another edge in the global AI race, and MSFT manages to attract and retain top talent to advance its business plan.

Metric

Value

Verdict

PE Ratio

38.61

Bullish

PB Ratio

11.52

Bearish

PEG Ratio

2.34

Bearish

Current Ratio

1.37

Bearish

ROIC-WACC Ratio

Positive

Bullish

Microsoft Fundamental Analysis Snapshot

An Extra Bullish Catalyst

Since its price gap to the upside on May 1st, 2025, the Bull Bear Power Indicator was in bullish territory on every trading session.

Microsoft Monthly Price Chart

How to Invest in META and MSFT?

I expect a market correction is likely to happen during the second half of 2025, and the Magnificent Seven will almost certainly play an outsized role in the sell-off if it happens. The massive strong gains are prone to profit taking.

So, I recommend buying the dip on Meta and MSFT. Patience and discipline are key. I also advise investors to split their capital into multiple entries rather than a one-and-done purchase. A 10% to 25% correction from current levels is reasonable, especially with the ongoing tariff war, economic uncertainty, and stubborn inflation. Stagflation risks worry me the most, followed by government debt and private credit.

Advertisement

META and MSFT have excellent long-term potential. I will use each 10% drop in the share price to add to the position. Rather than using a set share count, I will use dollar-cost averaging (DCA). It refers to buying the same dollar amount each time. For example, you would buy $5,000 worth of stocks in META and MSFT each during a 10% correction. It makes sense for buy-and-hold portfolios. Alternatively, I may increase my purchases if we witness a 30% correction.

The above content is all about "【XM Decision Analysis】--Two Magnificent Seven Stocks with More Upside Potential", which is carefully xmregister.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Decision Analysis】--EUR/GBP Forecast: Euro Continues to Stall Against the Po

- 【XM Group】--USD/CHF Forecast: US Dollar Continues to Climb Against the Swiss Fra

- 【XM Group】--BTC/USD Forex Signal: Taking a Bearish Retracement Turn

- 【XM Forex】--EUR/USD Forex Signal: Euro Crash Could Continue as Bears Eye Parity

- 【XM Market Review】--USD/PHP Forecast: Dollar Sideways Against Philippine Peso